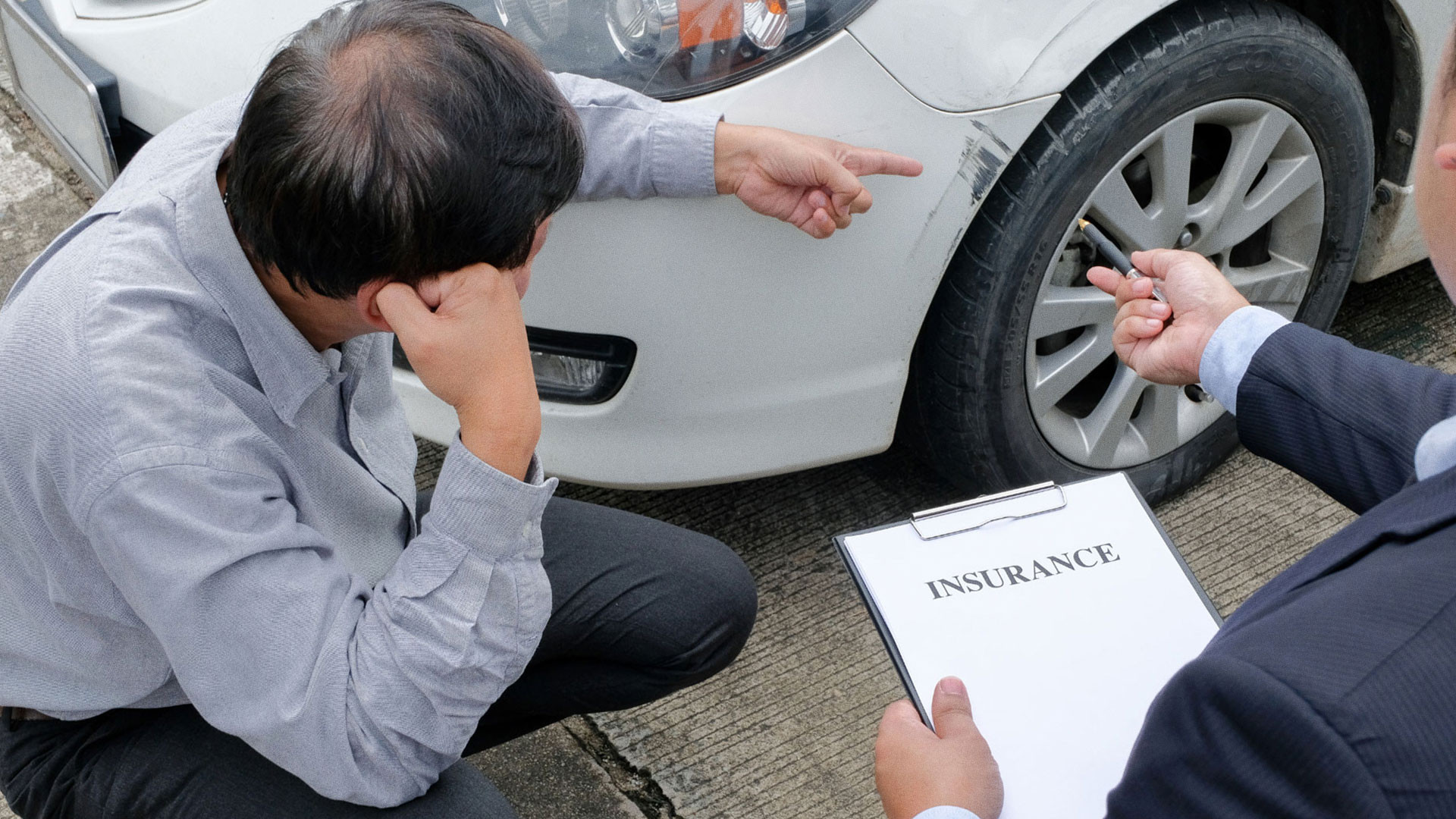

When it comes to driving, safety isn’t just about obeying traffic laws and being vigilant on the road—having the right car insurance is just as important. Car insurance provides financial protection in case of accidents, damages, and unforeseen events. However, many drivers, especially those new to insurance, often wonder, What exactly does car insurance cover? In this comprehensive guide, Get Drivers Ed breaks down the different types of coverage to help you make informed decisions.

Why Car Insurance is Important

Car insurance is a requirement in most states, including Texas. Having proper coverage protects both you and other drivers on the road. It provides a safety net for unexpected situations and can prevent you from facing significant out-of-pocket expenses. At Get Drivers Ed, we emphasize the importance of responsible driving and understanding your car insurance options.

Basic Types of Car Insurance Coverage

1. Liability Coverage

Liability insurance is the most basic type of car insurance and is mandatory in most states. It covers:

Bodily Injury Liability: Covers medical expenses, lost wages, and legal fees if you're at fault in an accident that injures others.

Property Damage Liability: Covers damages to another person’s property (like their car or a building) if you’re responsible for the accident.

Note: Liability insurance doesn’t cover any damages to your own vehicle or injuries you sustain. This type of coverage is essential for protecting you financially against lawsuits from other drivers.

2. Collision Coverage

Collision insurance covers the cost of repairing or replacing your car if it's damaged in a collision, regardless of who is at fault. This coverage is particularly valuable if you have a newer or more expensive vehicle.

For example, if you get into an accident on a busy Dallas street, collision coverage ensures that your repair costs are covered by your insurance provider, helping you avoid out-of-pocket expenses.

3. Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages caused by non-collision events, such as:

Theft

Vandalism

Natural disasters (like floods, fires, or hail)

Falling objects

Animal collisions

While it’s not mandatory, comprehensive coverage is highly recommended for those who live in areas prone to natural disasters or high crime rates. At Get Drivers Ed, we stress the importance of understanding how comprehensive coverage can offer peace of mind in unpredictable situations.

4. Personal Injury Protection (PIP)

Personal Injury Protection, often referred to as PIP, covers medical expenses and sometimes lost wages for you and your passengers, regardless of who is at fault in an accident. This coverage can be especially beneficial in states with no-fault insurance laws.

PIP coverage can be crucial for those who want added protection in case of injury. Medical expenses can quickly add up, and PIP coverage ensures that you’re not left financially vulnerable.

5. Uninsured/Underinsured Motorist Coverage

Not everyone on the road has adequate insurance, or any insurance at all. Uninsured/Underinsured Motorist Coverage protects you if you're involved in an accident with a driver who lacks sufficient insurance.

Imagine driving through Texas, only to be hit by someone without insurance. This coverage ensures that your medical bills and repair costs are taken care of, even if the other driver cannot pay.

For more details on car insurance requirements, consider enrolling in an Online Drivers Ed Course through Get Drivers Ed. This course provides valuable insights into safe driving practices and insurance needs.

Additional Car Insurance Options

Roadside Assistance

Roadside assistance coverage offers help when you’re stranded on the road. Services typically include:

Towing

Fuel delivery

Battery jump-start

Tire changes

Lockout service

This coverage is ideal for those who want extra security during long drives or road trips, especially around places like San Antonio and other vast Texas highways.

Rental Car Coverage

If your car is damaged in an accident, rental car coverage pays for a rental vehicle while yours is being repaired. This is a convenient option if you rely heavily on your car for daily activities and can’t afford the inconvenience of being without a vehicle.

How to Choose the Right Car Insurance

Choosing the right car insurance can feel overwhelming, but it’s crucial to assess your needs and budget. Here are a few tips from Get Drivers Ed to make the process easier:

Assess Your Risk: If you live in an area prone to natural disasters, comprehensive coverage might be necessary.

Consider Your Driving Habits: If you’re a frequent driver, collision coverage could save you from potential repair costs.

Evaluate Your Financial Situation: Choose a deductible and premium that suit your budget.

Review State Requirements: Texas has specific minimum coverage requirements, so be sure to meet those.

To learn more about state-specific insurance requirements, check out our Texas Online Driving Course for Adults on Get Drivers Ed.

Conclusion: Why Understanding Coverage Matters

Understanding what your car insurance covers can help you make informed decisions and ensure you’re adequately protected. From liability and collision to additional options like roadside assistance, each type of coverage plays a role in safeguarding you financially and physically on the road.

Get Drivers Ed encourages all drivers, whether seasoned or new, to stay informed about car insurance coverage. The right insurance policy not only keeps you legal on the road but also provides peace of mind in case of an accident or unexpected event.

For more tips on safe driving and insurance, consider signing up for one of our courses at Get Drivers Ed. Remember, a well-informed driver is a safer driver.